The User Experience of Investment Performance Reporting

Investment performance reporting plays an important role in maintaining a long-term advisor-client relationship.

The 2016 survey of retail and institutional investors, From Trust to Loyalty: A Global Survey of What Investors Want, conducted by CFA Institute, highlights transparency and communication among the key elements of a successful advisor-client relationship. The importance of investment reporting in particular is noted in the following excerpt from the survey:

By transparency, investors mean clear, forthright communication: regular, clear communication about fees; upfront conversations about conflicts of interest; and easy-to-understand investment reports.

In order to better understand the role investment reporting plays in an advisor-client relationship, it is perhaps useful to look at the core basic components of a successful advisor-client relationship.

Trust, Expertise & Communication

The December 2017 CNBC Personal Finance article by Sarah O’Brien provides some interesting insight into how the initial foundation of the advisor-client relationship is forged. The author, quoting Qualtrics® Financial Customer Experience Report, points out that wealth advisory clients value trust (47 percent) and investment track record (42 percent) as the main reasons for choosing a financial advisor. Interestingly, the same two factors, according to the author, are also why 71 percent of clients feel disappointed by their advisors. From the user experience standpoint, almost two-thirds of clients are disappointed with their investment relationship experience.

Choosing the right financial advisor is a difficult task for the investor. While it is possible to review potential financial advisor’s investment track record, establishing trust is often more difficult. Individual investors have their own personal definitions of trust. The initial interaction with the financial advisor, through a referral or otherwise, plays a critical role in establishing the foundation of a future relationship. At this important juncture in the advisor-client relationship, the burden is on the financial advisor to effectively communicate to the potential client the benefits of their relationship going forward, while also maintaining transparency in regards to the fees, client expectations, etc.

Once the initial relationship is established it needs to be carefully maintained and nurtured. Effective and clear communication, both on the part of the client and the advisor, plays a critical role. It is prudent for a financial advisor to have a well-defined client communication strategy, based on their experience and industry best practices.

While the core of the advisor’s communication strategy may be similar across a broad spectrum of clients, each client’s individual communications approach needs to be carefully tailored.

The Qualtrics® report points out that 10 percent of clients switched their financial advisors in the past ten years due to poor customer service, with another 10 percent quoting lack of personal attention. Lack of effective communication is the root cause of client dissatisfaction.

Financial Investment Reporting

As part of their communication strategy, advisors need to provide timely and easy-to-understand investment reporting to their clients. It is useful to look at the very nature of what constitutes a good financial investment report.

The Story

A Financial Investment Report is essentially a story. This story, often conveyed to the client through a multi-page document or an online portal, has the plot (overall performance), the characters (individual investments), and an outcome (investment performance) in the case of the year-end financial report. As with any story, the storytelling itself plays a critical role in how the audience responds to the story. When the number of characters (individual investments) is large and diverse, the clarity of the investment report storytelling cannot be overlooked.

The Information

At the very core of any investment report is financial information. The sheer volume and scope of information can be overwhelming, even for an experienced investor. It is important that the advisor takes great care in presenting this information to the investors through easy-to-understand body copy, and well-designed visual components.

Advisors understand that some of their clients do not have the background to properly interpret the complexity of financial data, let alone derive informed and educated conclusions from it. The structure and the organization of the data presented in the performance report needs to be clear and concise.

The copywriting style of investment reports needs to be carefully analyzed to make sure that it supports and enhances the overall clarity of the message. A business copywriting consultant may be brought on board to review the proper style and provide appropriate recommendations. This would be of particular importance for international clients, whereas the investment reports may need to be generated in languages other than English. In this case an investment firm may retain the services of a business translation agency to assure proper translation. The cost, although substantial, may be offset by a potential significant increase of advisor’s assets under management.

The Visuals

Many visual components of an investment performance report play an important role in the overall success of the client’s investment story. The visual elements, designed and presented effectively, enhance the storytelling process. Stylistic, compositional and other considerations need to be analyzed. Layout structure, visual sequence, compositional patterns and color schemes help the viewer easily understand and effectively interpret the content.

The overall look and feel of the presentation need to adhere to the overarching brand guidelines, governed by the investment institution or an independent advisor. Compositional and layout structure, color and typography systems, and other visual presentation elements play an equally important role.

The Data

Special consideration should be given to the Data Visualization of an investment performance report. Various data visualization software packages offer a myriad of data visualization techniques. One of the leading data visualization tools, Tableau®, offers thirteen data visualization methods, among them histogram chart, bar chart, line chart, pie chart, map, scatter plot, Gantt chart, bubble chart, bullet chart, heat map, highlight table, tree map and box-and-whisker plot. The challenge is to find the most appropriate data visualization tool for the intended audience as well as the type of data presented.

Delivery to Investors

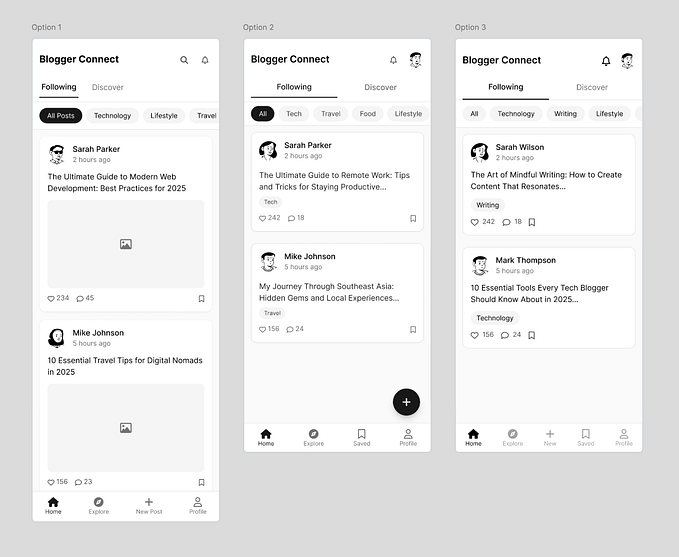

It is important to mention that the above elements have to translate well across multiple formats, such as print and web, which include desktop and mobile. Currently many financial firms offer their clients the flexibility of hard copy mail delivery as well as online access to downloadable reports in PDF format.

The more recent trend of on-demand reporting enables clients to access the current state of their investments via a dedicated online portal. The ability to generate on-demand reports, in conjunction with consultation with their advisor, may provide additional benefits to the advisor-client communication. In his August 2016 newsletter story Andrew Davidson, a Salesforce.com Strategic Innovation Executive, looks at contextual insights as “one of three successful ways to boost productivity by using technology and journeys in today’s (advisor) environment.” As part of contextual insight, he explores the idea of automatically-generated “client performance reports, available on demand, and (which) include insights and recommendations that aren’t based on arbitrary dates, but on clients’ actual lives.”

Conclusion

Effective communication, in all of its forms (meetings, emails, phone calls, online, and in print) is the most powerful tool that financial advisors can have in their toolkit. If financial advisors are able to deliver a positive user experience to their clients, this may assure a longer, mutually beneficial relationship.